Overseas passengers return to Kai Tak with official opening of HK$8.2b cruise terminal

The city's new cruise terminal is an HK$8.2b bet to revitalise east Kowloon and diversify the source of tourists visiting Hong Kong

Thursday, 13 June, 2013, 6:19am

Passengers disembark from the Celebrity Millennium at Kai Tak, when it docked at the terminal during a trial run in March. Photo: Felix Wong

For decades, low-flying jets approaching Kai Tak airport, thundering over the heads of residents in Kowloon City, were a unique if noisy feature of old Hong Kong.

The airport, with its single runway jutting into the harbour at a hair-raising angle to Lion Rock, was regarded as one of the toughest landings for even the most experienced pilots. Its closure in 1998 marked the end of the Kai Tak era as the city's transportation hub. The land remained bare save for a few temporary buildings for much of the next decade.

The airport, with its single runway jutting into the harbour at a hair-raising angle to Lion Rock, was regarded as one of the toughest landings for even the most experienced pilots. Its closure in 1998 marked the end of the Kai Tak era as the city's transportation hub. The land remained bare save for a few temporary buildings for much of the next decade.

But while the roar of low-flying jets is a thing of the past, passengers' luggage is returning to the area as it once again becomes a centre for transport and tourism .

Built at a cost of HK$8.2 billion, the Kai Tak Cruise Terminal finally welcomed its first visitors yesterday after years of planning and construction. Carrying more than 3,000 passengers and making her maiden voyage to Hong Kong, the 310-metre, 15-deck Mariner of the Seas would have been too big to berth at Ocean Terminal in Tsim Sha Tsui.

The government is pinning its hopes on the cruise terminal to boost tourism and help revitalise the eastern end of Kowloon, for which it has ambitious plans.

But questions remain about the wisdom of the project. Will the terminal ever be full? Will passengers and cruise operators want to dock in Kowloon Bay, far from the centre of the city and with limited public transport, at least for the time being? And can Hong Kong attract enough passengers to justify the huge investment and use of scarce land?

The cruise terminal can accommodate the largest cruise ships in the world, of up to 220,000 gross tonnes, the size of Royal Caribbean's Allure of the Seas. The facility boasts customs and immigration halls that can clear 3,000 passengers an hour, a massive car park for hundreds of vehicles, and a 23,000-square-metre landscaped deck, one of the largest public roof gardens in Hong Kong. Columnless waiting halls can be converted into exhibition and convention venues outside the peak cruise season.

But for the first 10 months of operations, until next April, the terminal has just 20 bookings for a total of 30 days of berth occupancy, meaning the one berth that is open so far will be empty far more frequently than it is full.

The government and the terminal's operator say that is no reason to worry. They say it takes international cruise lines about 18 months to make adjustments to the deployment of vessels around the globe, meaning the bookings will rise only gradually.

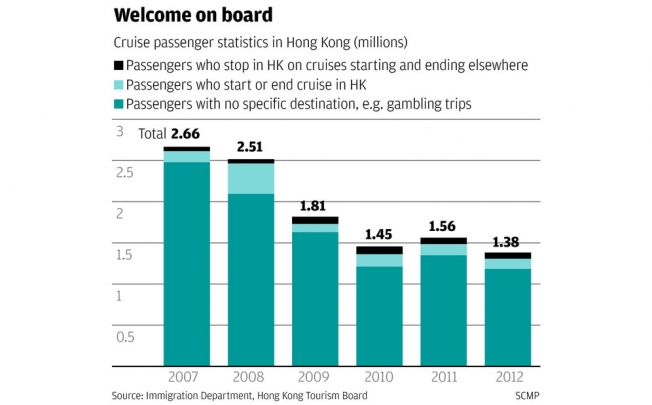

Between 2007 and last year, the total number of cruise passengers passing through or beginning or ending their journeys in Hong Kong declined sharply by 48 per cent to 1.38 million. Most of that was due to a 52 per cent fall in the number of passengers taking cruises with no other destination - gambling cruises that sail to international waters where players can bet legally before returning to port.

Excluding the gambling cruises, the number of passengers rose six per cent. Transit passengers - those who start and end their cruises elsewhere - were up 42 per cent, but the total remained small at 77,536 last year. The number who started or ended their cruise in the city dipped 8 per cent to 121,000.

Hongkongers seem to have lost their sea legs. The number of them who joined multi-city cruises that passed through the city fell by 68 per cent to 15,000 per year during the same period.

And while destinations around the world are cashing in on the growth in mainland tourism, few are taking cruises featuring a Hong Kong stop. Their numbers increased just 4.4 per cent to 28,137 in the five years to 2012, a time when the number of mainland visitors to Hong Kong increased from 15.5 million a year to 34.9 million.

The latter figure goes some way to explaining why the city is so keen to invest in cruise facilities - it's a way to diversify its source of tourists, providing a hedge against a future drop in mainland visitors and strengthening its reputation as "Asia's world city".

Indeed, the number of Australians passing through Hong Kong on ships in the five years to 2012 more than doubled to 34,465 in the six years to last year. The number of American and European cruise visitors also rose, by 17 per cent and 12 per cent respectively.

A much bigger incentive for investment is the "Asian dream" promoted by the cruise industry, which sees the region as its next big frontier. With more cruise lines deploying vessels to Asia to tap into the rapidly growing market, Hong Kong must join the race or miss the opportunity, tourism industry executives say.

According to industry website Cruise Market Watch, the global cruise industry is projected to grow at an annual compounded rate of 7.4 per cent to 22.4 million cruise passengers by 2015.

Pier Luigi Foschi, chairman of the Asian arm of the world's biggest cruise company, Carnival, expects the total number of cruise passengers in Asia to reach as many as 3.7 million by 2017 and then increase to more than seven million by 2020.

"There's a lot of work to do to make this a reality. In 2013, Asia represented just under 5 per cent of total allocated beds for us, which is in line with the overall Cruise Lines International Association figures for their major member lines," said William Harber, vice president of market development for Carnival Asia.

At present, the 34 per cent of the cruise market is the Caribbean, 29 per cent in the Mediterranean and 10 per cent in Europe outside of the Mediterranean.

Carnival's Costa brand has doubled its capacity in Asia, while its Princess line will be bringing its ship Sapphire Princess to the region next year to join her sister ships Diamond and Sun.

Royal Caribbean Cruises, the second-largest cruise company and one of the partners operating the Kai Tak terminal, also has high hopes for the region.

"We started full-year deployment in Asia in 2010. Before that, we had seasonal sailings instead of year-round deployment," managing director for China Dr Liu Zinan said.

Two vessels, Legend of the Seas and Voyager of the Seas, were in Asia last year. Legend was replaced by the larger Mariner of the Seas this year, and the vessel will embark on round trips from Hong Kong to Taiwan this autumn.

The approach to vacationing in Asia is changing, Liu says. Sightseeing and shopping were the main reasons to holiday in the past, but more and more people recognise cruising as an option for leisure travel.

"My expectation is that China and Asia will become the second-largest source market, surpassing Europe and coming after the United States," he said. By the end of this year, about 500,000 Chinese passengers will be starting or ending a cruise trip in their home country, Liu added.

In the long run, regional growth is guaranteed by upgrades to infrastructure across the board, he said. In Japan, local governments are expanding port capacity. In South Korea, a new terminal will open in Busan in 2015.

New terminals have already opened in Tianjin and Shanghai in 2010 and 2011, but they are not competing for guests with Hong Kong, he said.

The two ports target northern and eastern provinces respectively, while Hong Kong aims at the southern market, including Guangzhou and Shenzhen.

"Each market is big enough… and about the size of Australia in terms of population," he said. "Hong Kong itself is also an important market. And having the city in the itinerary will attract international guests."

Liu has been encouraged by promises from the central government to help mainland passengers secure the visas they need, allowing cruise firms to offer more flexible itineraries.

In the past, mainland cruise passengers sailing from Hong Kong could go only as far as Taiwan. But under the Closer Economic Partnership Arrangement signed last year, authorities have promised to allow Japan and South Korea to be included in itineraries.

The promise has yet to materialise, as cruises from China to Japan came to a halt due to the territorial dispute over the Diaoyu Islands, which Japan calls the Senkakus.

For signs of how it could benefit from the Asian cruise boom, Hong Kong can look to the example of Singapore, which opened a new cruise terminal at Marina Bay last year.

From 2003 to last year, its cruise passenger throughput grew by an annual compound rate of 6.5 per cent to 913,000. While the number of ship visits fell from 717 in 2007 to 394 in 2012 as gaming ship operations were terminated, the Southeast Asian island state is hoping that bigger ships arriving at its new terminal will bring in more high-spending tourists.

The new terminal already serves as the home port for ships cruising to Malaysia and Thailand. The number of ships making their first visit to the city more than tripled from three in the year before the new terminal opened to 11 in the year since, said Edward Chew Chin-heng, the Singapore Tourism Board's regional director for Greater China.

The key to attracting cruise lines to make a city their home is prove to them it is a viable business decision, he said.

Maintaining healthy local demand for cruises is essential - 40 per cent of passengers are Singaporeans, Chew says.

The government should promote cruise tourism in potential source markets and constantly develop new itineraries, he adds. A sub-group under the Association of Southeast Asian Nations is responsible for co-ordinating Southeast Asian ports, he said.

"We are hopeful that Southeast Asia will be the new Caribbean and Mediterranean. What we are particularly excited about is the diversity of cultures and landscapes. That makes a good itinerary," he said.

Investing in the cruise sector is a long-term and continual commitment. Singapore has reserved space for more berths at Marina Bay if necessary, he adds.

Apart from tourism receipts, more cruise vessels also mean more business for shipyards, he says. One Singaporean yard received 12 orders for refits and servicing in the first few months of the terminal's operation, twice as many as the entire previous year.

The competition between Hong Kong and Singapore is not a zero-sum game, Chew says: "We've got to have more than one destination… we are part of the same product."

Singapore would like to co-operate with Hong kong to train tour agents responsible for excursions, and to promote cruising as a viable option of travel in Asia, Chew said.